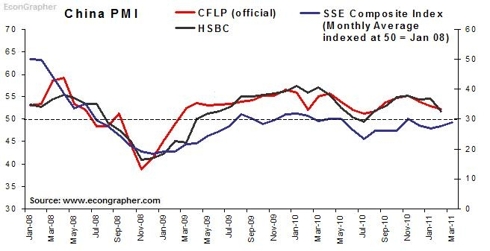

1. China PMI

China's February PMI readings showed a few seasonal quirks, but also pointed to rising inflationary pressures. The official CFLP PMI was 52.2 vs 52.9 prev, and the HSBC index was 51.7 vs 54.5. Though both indexes fell, they remained above 50 and generally did not point to any significant slowdown. The key warning signal that did come out of the numbers was for further upside inflation risks. The HSBC "Input Prices" sub-index came in at 74.6 vs 71 in January, as rising commodity prices put increasing upward pressure on prices in China and other emerging markets. The HSBC index also showed a rise in the backlogs of work, with rising capacity constraints showing through.

2. US PMI

The U.S. impressed once again with its manufacturing Purchasing Managers Index results. The main PMI index crept up a further 0.6 to 61.4, the highest level since the early 1980's. New orders added 0.2 to 68.0 and the employment sub-index added 2.8 to 64.5 as more employers signaled higher staff (a net 26% expect higher employment). On the non-manufacturing side, the NMI rose to 59.7 from 59.4, with the standouts being business activity +2.3, inventories +6.5, and most interestingly, new export orders +3 points to 56.5 (compared to the imports index at 53.4). Both indexes signalled rising cost pressures with the NMI prices sub-index up 1.2 to 73.3, and the PMI prices sub-index up 0.5 to 82 - showing that inflation is not dead.ff

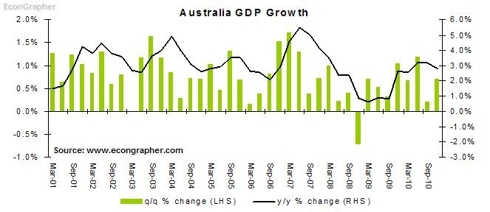

3. Australian GDP

The Australian economy produced a solid yet uninspiring GDP result for the final quarter of 2010. The Aussie economy expanded at a q/q growth rate of +0.7% (or 2.8% annualized), placing y/y growth at +2.7%. The majority of the growth came from inventory-building, with net exports neutral, and an insipid contribution from consumption. Thus the Australian economy appears to be passing through the hard part of its recession-free recovery. The outlook for the Australian economy is relatively strong growth - perhaps about 3%, and it's likely that any further tightening from the RBA will be pushed out well into the second half of this year.

4. US Nonfarm payrolls

The US recorded a bumper month, by recent standards, in February with 192k jobs added (compared to 36k in January). Private payrolls were up 222k, compared to 50k in Jan. The unemployment rate fell slightly to 8.9% - which is not that meaningful in the scheme of things. Average hourly earnings were flat, as was the average workweek. Thus overall it was a decent result in terms of the number of jobs added, sure some of it was January hiring being pushed into Feb, but a few more months like this would start to make a difference. As it stands, payrolls are still down a net -7.47 million since the start of 2008, so yeah, still a long way to go (oh and since January 2000, payrolls are net negative by about 30k, so who knows - next month could mark the start of a net positive number!).

5. Monetary Policy

In monetary policy the main standout for the week had to be the ECB's tough talking, and rhetoric that hinted at an impending rate hike - perhaps as soon as April. The other big one was Brazil tightening another 50bps, sending the Selic rate to 11.75% as it seeks to rein in rising inflation. Likewise Azerbaijan +200bps, Tajikistan +75bps, and the Dominican Republic +100bps also lifted rates to stave off rising inflation, driven by a spike in food and energy prices. So the usual theme of rising commodity prices and emerging market inflation was highlighted again - but the interesting part was the developed markets story. The European Central Bank specifically noted its concerns about the second round effects of rising commodity prices; so again, inflation is not dead...

Summary

So we saw China put out lower PMI figures, pointing to what will most likely be a temporary tapering off of activity, but more importantly; signaling rising inflationary pressures. Over to the US there was a much more positive PMI result, with some promising signs of strength in activity levels, but the costs pressures signals were also there. In Australia the economy is chugging along as per usual, though the 2010 Q4 results, though positive, were a little less inspiring. Back to the US, the February payrolls figure was a strong one, but there's still a lot more work to be done to get back even close to normal. Meanwhile in monetary policy, the ECB sent strong signals about and impending rate hike, and emerging markets, including one of the BRIC economies, continued to lift interest rates in response to their not-so-unique rising inflationary pressures situation.

Sources

1. CFLP www.chinawuliu.com.cn & Markit/HSBC www.markiteconomics.com & Yahoo Finance finance.yahoo.com

2. Institute for Supply Management www.ism.ws

3. Australian Bureau of Statistics www.abs.gov.au

4. Bureau of Labor Statistics www.bls.gov

5. CentralBankNews.info www.centralbanknews.info

Article Source: http://www.econgrapher.com/top5graphs6mar11.html

No comments:

Post a Comment

What do you think?