1. US GDP

The US saw 4th quarter 2010 GDP revised up, with the final reading showing the US economy rose 3.1% on a seasonally adjusted annualized rate in Q4. The reading compares with 2.8% in the previously released result, and is up from Q3's 2.6%. The upward revision reflected stronger inventories, non residential building investment, equipment and software investment, and even residential investment. The results reflect the theme of a manufacturing lead recovery, with business starting to become more confident in investing in their business, and gradually rising internal and external demand. The US economy is likely to gain momentum through 2011, with corporate earnings likely to also gain momentum as analyst forecasts for S&P 500 earnings point to growth as great as 15% year on year in H2 2011. However there are due downside risks, such as the state of the global economy, and the US fiscal situation.

2. France GDP

France reported GDP growth of 0.4% in Q4, revised up from 0.3% (with third quarter GDP being revised down to 0.2% from 0.3%), and placing GDP up 1.5% on an annual basis. The figure was boosted by a rise in household consumption expenditure, with final domestic demand making a positive contribution, and investment growth making a marginal contribution. Net exports also positively contributed as import demand slowed. Inventories had a net negative contribution. The Bank of France is forecasting economic growth to gain momentum this quarter, with growth expected to come in at around 0.8% in 1Q11. Also of interest was the French consumer confidence numbers, which showed consumers concern with inflation taking precedence over concerns with unemployment, confirming comments by the European Central Bank on the risks of second round inflation effects from rising commodity prices.

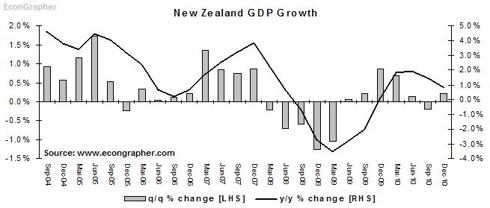

3. New Zealand GDP

The New Zealand economy grew 0.2% q/q in the December 2010 quarter (-0.2% 3Q10), placing it up 0.8% year on year (1.5% 3Q10). The strongest sectors on a quarterly basis were fishing, forestry and mining, manufacturing, construction, and personal and community services. While the worst performing sectors were wholesale trade, retail, accommodation and restaurants, and utilities. So it was basically the primary sectors doing well, with the consumer sector still struggling. Thus the results overall were hardly spectacular, but the outlook is more promising, with the earthquake rebuilding effort likely to start making positive contributions as early as H2 2011. In addition, the Rugby World Cup will also add tourism revenues and boost the consumer sector. High agricultural commodities will boost the primary exporting sector, particularly dairy. And loose monetary policy will also assist the economic recovery.

4. UK CPI

The United Kingdom fell prey to the global inflation trend, with its annual CPI inflation rate rise to 4.4% in February this year, beating expectations of 4.2%, and rising from 4.0% in January. The figure will no doubt irk the Bank of England, which is likely to come under increasing pressure to raise rates from excessively stimulatory levels (0.50%). Indeed, in its most recent meeting minutes the Bank of England noted it is likely that inflation will rise to as much as 5% or more, before normalizing, with the Bank expecting inflation to fall back to the official inflation target of 2% in 2012. Inflation in the UK is still being boosted by the one-off effect of sales tax rises, and the impact of strong commodity prices. While these are in theory one-off/temporary effects, there is still a risk that inflation expectations may rise. Provided the economic situation doesn't materially deteriorate it is likely the BoE will start normalizing monetary policy before long.

5. Monetary Policy

The week in monetary policy was characterized by further emerging market monetary policy tightening with the following central banks lifting policy rates: Nigeria +100bps to 7.50%, Kenya +25bps to 6.00%, Uruguay +100bps to 7.50%, and the Philippines +25bps to 4.25%. Meanwhile two Central Banks held their policy rates, but tightened reserve requirements; Turkey +300bps to 15%, and Russia +100bps to 5.5% (and +50bps to 4%). For emerging markets, monetary policy continues to be the wild card. If emerging markets are able to tackle the inflation challenge successfully without growth taking too much of a hit then emerging market equities are likely to bring in strong returns - especially coming off current modest/reasonable valuation levels. However the obvious flip side is the policy risk puzzle, with the possibility of hard landings coming from over-tightening.

Summary

So we saw the US revising its GDP growth numbers upward as the US economy gained momentum, with all signs pointing to a strong 2011 - but with due downside risks. France likewise upgraded its GDP numbers in Q4 2010, but with momentum rising, also showed signs of rising inflationary pressures. Meanwhile New Zealand reported a marginally positive but relatively weak Q4 GDP result, but with the conditions coming into place to support a strong 2011, particularly in the later half of the year. Over to the UK, British inflation rose further, adding increasing pressure on the Bank of England to start normalizing monetary policy. While emerging markets continued their monetary policy tightening campaign to rein in rising inflation on the back of commodity prices and strong economic growth.

Sources

1. US Bureau of Economic Analysis www.bea.gov

2. OECD Statistics Database stats.oecd.org

3. Statistics NZ www.stats.govt.nz

4. Trading Economics www.tradingeconomics.com

5. CentralBankNews.info www.centralbanknews.info

Article Source: http://www.econgrapher.com/top5graphs26mar11.html

No comments:

Post a Comment

What do you think?